Home equity loan rates & HELOC calculator

Table of Content

As your payments during the draw period are applied to the principal amount you owe, your available credit increases. Once the draw period ends, the repayment period begins. Many HELOCs allow borrowers to make interest only payments during the draw period, which can vary. When that period ends, you must make principal and interest payments. The minimum amount you will need to pay each month on your home equity line of credit Fixed-Rate Loan Option.

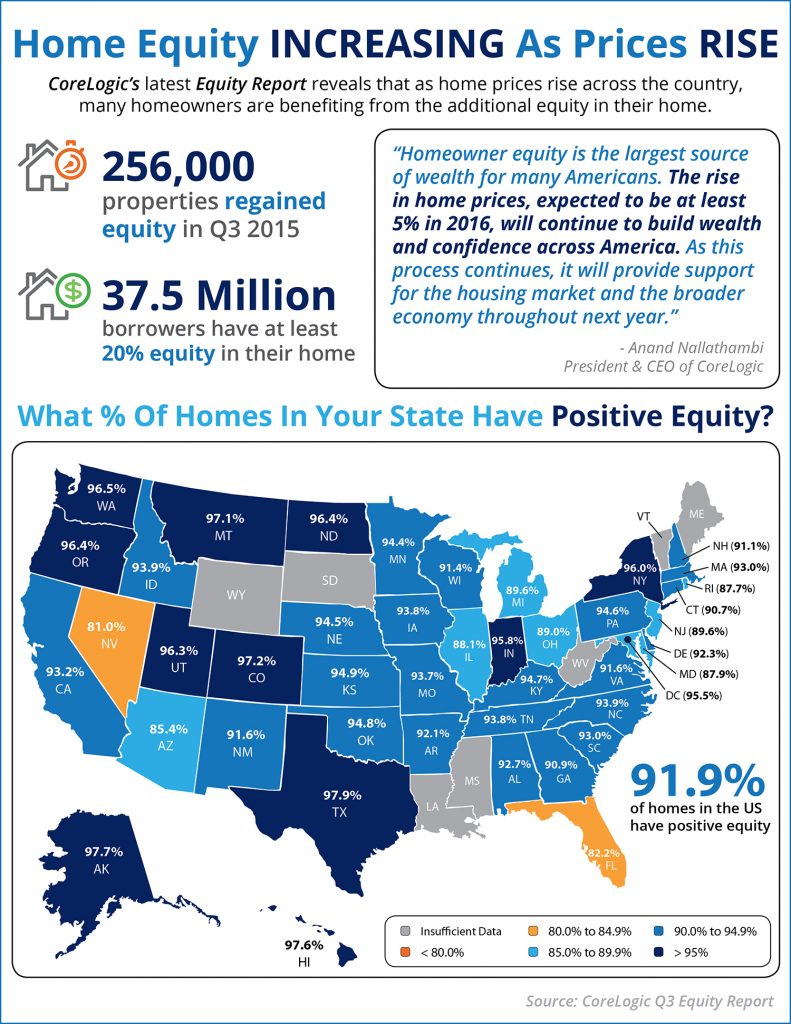

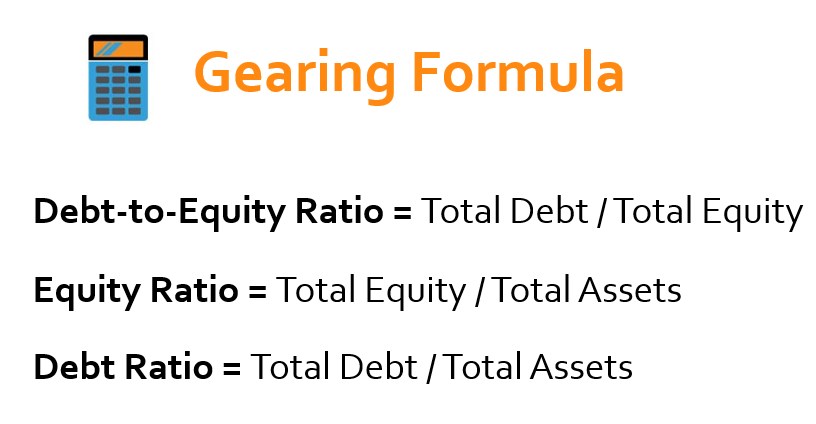

Lender requirements vary but, in general, you’ll need to have at least 20% equity in your home to qualify for a loan. Home equity loans are a type of loan that uses your home as collateral and allows you to borrow against that equity. While the calculator can give an estimate of how much you can borrow, talk to your lender to get accurate results based on a wider range of information. Borrowers can deduct the interest paid on HELOCs and home equity loans if they use the funds to buy, build or improve the home that serves as collateral for the loan. Both options require you to have a certain amount of home equity; this is the portion of the home you actually own.

How we make money

Easily customize your banking experience with a variety of accounts designed to give you exactly what you need. Check out our current promotions and exclusive offers, all wrapped up for you to enjoy. Forbes Advisor adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners.

The minimum monthly payment shown in your results reflects interest-only monthly payments. A home equity loan can be a less expensive option for borrowers who need access to cash. But refinancing can be a great way to lower your monthly payments and save money on interest.

Diverse business resources

It’s simple to upload documents – no fax machine or trip to the bank necessary! And if you need to step away from your application, just save it to finish later. Depending on your situation, discussing your home equity options with a banker might be your best next step. Bankers are available for virtual, phone and in-person appointments. For a list of your home equity options, enter your loan criteria.

Before that, she covered macro and central banks for Investor's Business Daily, and municipal bonds for Debtwire. The calculator will estimate your loan amount based on this information. If you don’t have enough equity in your home or your credit score is low, you may not qualify for a home equity loan. To apply for a home equity loan, start by checking your credit score, calculating the amount of equity you have in your home and reviewing your finances. Building home equity is the first step to obtaining a home equity loan.

Home Equity Loan Calculator

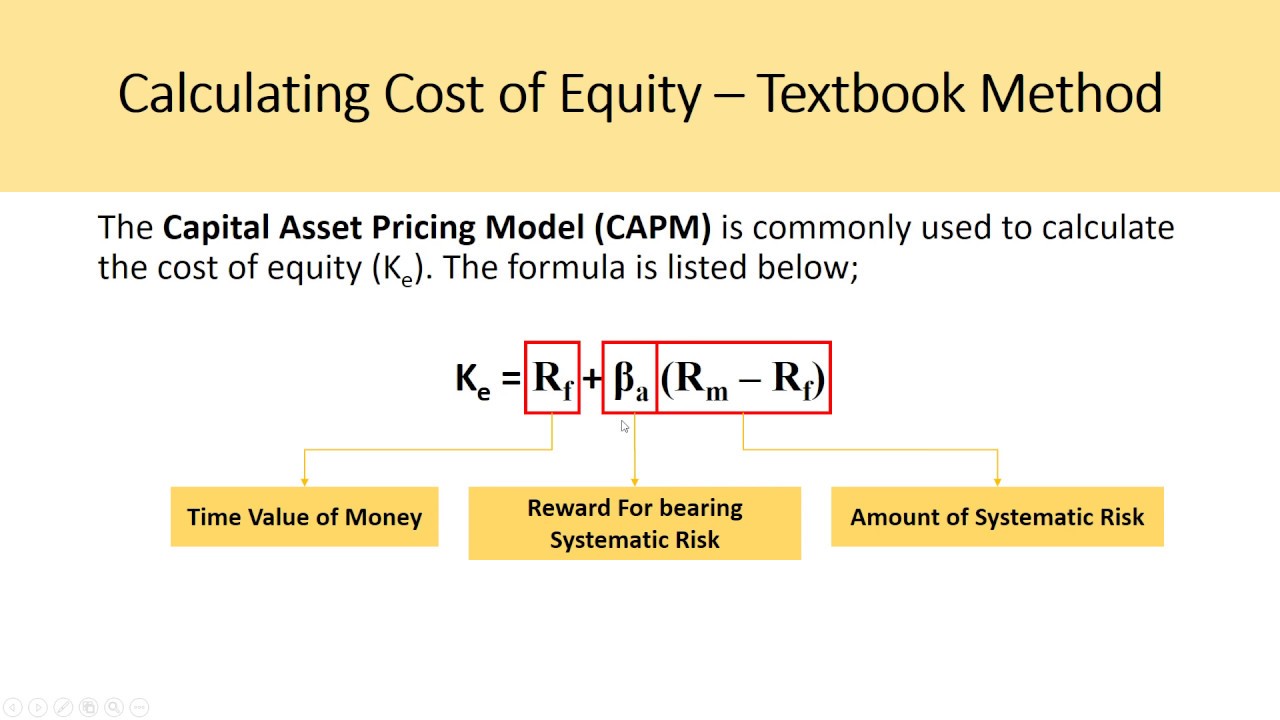

Learn about a HELOC, how a variable rate is calculated and how to get a Fixed-Rate Loan Option. An interest rate that may fluctuate or change periodically, often in relation to an index such as the prime rate or other criteria. Home equity is the difference between the market value of your home and the amount you owe on your mortgage. With our streamlined application process, you can apply using your phone, laptop or other portable device.

Home equity is the difference between the market value of your home and any remaining loans that are owed on the property. A Loan Estimate provides important details about your loan, including the estimated interest rate, monthly payment and total closing costs. A banker can help you obtain a Loan Estimate without completing a full loan application.

Business services

To calculate your home’s equity, divide your current mortgage balance by your home’s market value. For example, if your current balance is $100,000 and your home’s market value is $400,000, you have 25 percent equity in the home. The amount you can borrow is based largely on your loan-to-value ratio, or LTV ratio.

This steep rise in the monthly HELOC payment can be a shock to borrowers who were making interest-only payments for the first 10 or 15 years. Sometimes the new HELOC payment can double or even triple what the borrower was paying for the last decade. In a line of credit, the period when no advances of principal are available and during which the line must be fully repaid, according to the payment terms. In a home equity line of credit, the repayment period is the portion of the loan term that follows the draw period. An early closure fee of 1% of the original line amount, maximum $500, will apply if the line is paid off and closed within the first 30 months. An annual fee of up to $90 may apply after the first year and is waived with an existing U.S.

Whether you’re looking to put down roots in your dream home or wanting to upgrade your ride, the best loan options with low rates live here. Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website.

Interest rates and program terms are subject to change without notice. Credit line may be reduced or additional extensions of credit limited if certain circumstances occur. Home equity loans not available for properties held in a trust in the states of Hawaii, Louisiana, New York, Oklahoma and Rhode Island. Repayment of a home equity line of credit requires that the borrower makes a monthly payment to the lender. For some home equity lines of credit, borrowers can make interest-only payments for a defined period, after which a repayment period begins.

Customers in certain states are eligible to receive the preferred rate without having a U.S. The rate will never exceed 18% APR, or applicable state law, or below 3.25% APR. Choosing an interest-only repayment may cause your monthly payment to increase, possibly substantially, once your credit line transitions into the repayment period. Repayment options may vary based on credit qualifications. Loans are subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts.

Cash you need now is the amount of money you would like to withdraw when you open your line of credit. This would typically be money to pay for major expenses, pay down existing debt or other needs. Receive the best home equity and mortgage rates every month right to your inbox. Explore Bankrate's expert picks for the best home equity lines of credit.

Comments

Post a Comment